A cash payment journal, also known as a cash disbursement journal, is used to record all cash payments (or disbursements) made by the business.

Examples of major cash payments in a business that may be recorded in the cash payment journal are:

The cash payment journal is used to record the cash disbursements made by check, including payments on account, payments for cash merchandise purchase, payments for various expenses, and other loan payments.

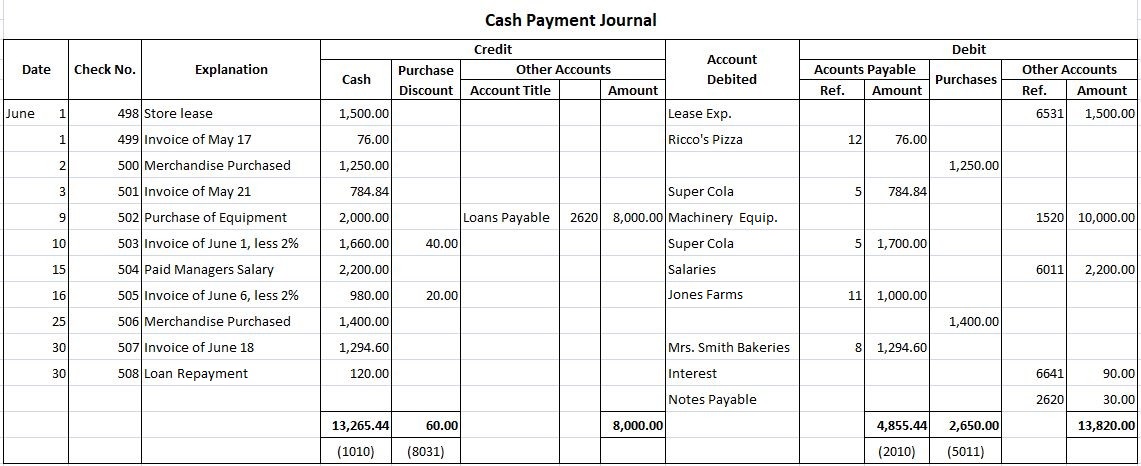

A typical cash payment journal is shown in the example below. The journal has a Date column, a Check Number column, a Payee column, and at least two credit columns, one for cash and one for purchase discounts. The other credit column is for Other Accounts.

If necessary, other specific account columns can be added if they are used routinely. The debit columns will include at least an Accounts Payable column, a Purchases column, and the Other Accounts column.

Again, other specific account columns can be added if needed. The main source of entries for this journal are check stubs and payment requests.

To demonstrate how entries are recorded in the cash payment journal, consider the following data from Fortune Retail Store concerning its cash payments during the month of June:

The entries in the cash payment journal are recorded and posted in a similar manner to those in the cash receipts journal. Thus, the entries are entered sequentially into the cash payment journal as they occur.

The cash payment journal is also posted in two stages. Entries to the Accounts Payable account should be posted daily to the subsidiary accounts payable ledger.

At the end of the month, all amount columns are summed. All the totals, except those in the other columns, are posted to the appropriate general ledger accounts. The accounts in the other columns must be posted individually.

They can be posted daily, monthly, or at other convenient intervals. Given that the basic posting procedures are the same as those for the other journals, the actual postings are not shown in the exhibit.

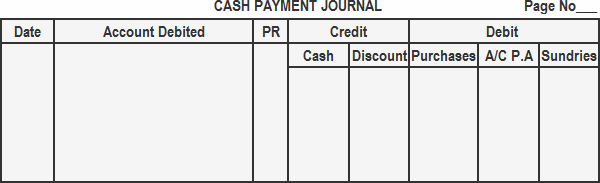

Like a cash receipts journal, various formats are used for cash payment journals. The type of format chosen depends on the needs of the individual business. A simple format is given below:

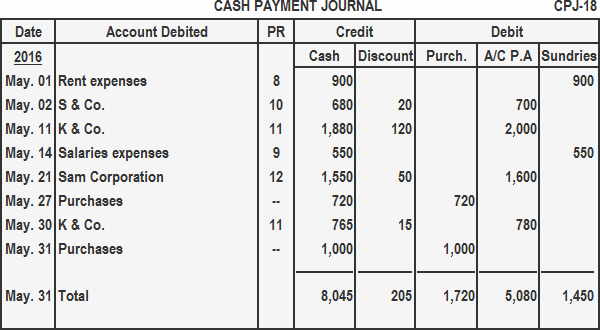

Record the following cash transactions for 2016 in a cash payment/disbursement journal.

The procedure for posting the cash payment journal to ledger accounts is described below:

A cash payment journal, also known as a cash disbursement journal, is used to record all cash payments (or disbursements) made by the business.

To use a cash payment journal, businesses must first set up the journal in their accounting software. Once the journal is set up, businesses will enter each cash payment into the journal as it occurs. The journal can then be used to generate reports on spending and to track outgoing cash flow.

The main benefit of using a cash payment journal is that it provides businesses with a record of all cash payments made. This can be helpful in tracking spending and cash flow. Additionally, the journal can be used to generate reports on spending, which can be helpful in budgeting and financial planning.

One challenge associated with using a cash payment journal is that it requires businesses to enter each cash payment into the journal manually. This can be time-consuming, especially for businesses that make many cash payments. Additionally, if cash payments are not entered into the journal promptly, it can be difficult to track spending and cash flow accurately.

The main difference between a cash payment journal and a cash receipts journal is that a cash payment journal tracks outgoing cash flow, while a cash receipts journal tracks incoming cash flow. Additionally, businesses typically use different formats for these two journals. A cash payment journal usually has more detail than a cash receipts journal, as it includes information on the individual payments made.